Citicourt & Co Limited (“Citicourt”), has completed advising on the management buyout (“MBO”) of Arthur Murray International, Inc. (“Arthur Murray”), an international franchisor of dance studios. The 112-year-old company now counts 300 dance studios in two dozen countries across the globe. The MBO team was led by UK based Gary Edwards, an ambassador for Arthur Murray for the last 20 years, who will serve as CEO.

Citicourt of London: We are the strategic Series A/B round investor for Earth observation companies

March 17, 2025

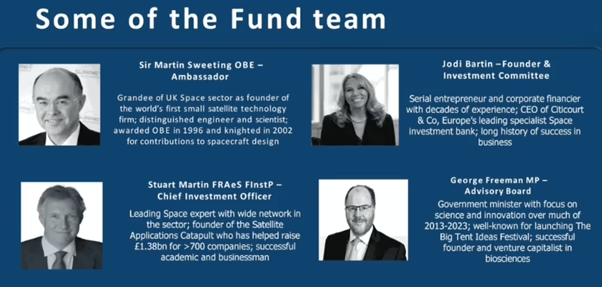

Jodi Bartin. Credit: Citicourt

LA PLATA, Maryland — It’s generally agreed that while Europe has come a long way in funding space startups, it still falls short in helping companies traverse the “Valley of Death” after they begin selling products and generation revenue but do not have the scale to expand their businesses.

Citicourt & Co. Ltd of London looks ready to step into that gap with a planned Space4Earth fund to start this year to invest in Series A- and B-rounds.

Investments will focus on four “impact pillars”: efficient and sustainable food production, clean water, deforestation and decarbonization.

Citicourt Chief Executive Jodi Bartin said the fund is aiming at 100 million British pounds ($126 million) but will close with as little as 30 million pounds.

In an interview, Bartin and Stuart Martin, Citicourt’s director of space — and former CEO of UK Satellite Applications Catapult — outlined their reasoning and how they see the space investment market.

Focusing on A- and early-B round is not common among space investors in Europe. What attracted you to it?

Bartin: Late A early B is where there is a J-curve at the moment, where space companies are generating revenue, not profitable but well under way, and with good recurring revenue but in need of growth and expansion capital.

More importantly, they need a strategic investor and we want to be that investor. We filtered 4,000 companies to find our first three investments in pre-closing the fund. They are all Earth observation, but all very different in terms of commercial applications.

With our corporate finance arm we speak to about maybe 100 deep-tech firms a month. They are constantly telling us: We want to do a space investment but we don’t want to be lead because we don’t understand space. When you find a lead, we will follow.

We’re going to be the lead investor for a generalist investor’s syndicate. So not only will generalist investors be coming into our fund, but we want to lead generalist investor syndicates.

How far are you from getting there?

Bartin: It’s not done yet. But we really want to transform the financial services sector in London around space and do it in the next 18 months, so that they create a financial services industry for the space sector in London. The fund itself is an unregulated Guernsey-based fund but Citicourt is an investment advisor to the fund.

What we look for is value. We are looking for companies that will have early uplift in valuation. And they have to satisfy three of our impact pillars.

Would this be the usual five- to seven-year investment before an exit?

Bartin: Yes. We want to see that they are getting ready to land a big contract, ready to do something that will have substantial commercial uplift that will have an impact on the next round of their funding.

The categories you have selected are markets whose customers are 90%-plus government, correct?

Stuart Martin. Credit: Citicourt

Martin: This market is moving in different directions at the moment.

Look at water management. The initial customers most likely are governments trying to understand how water moves around their geography and how it will move around in the years ahead. They’re looking at policy and regulation to help them manage that water.

Once they’ve got that in place, there will be another layer of customers coming in from the industrial side and also on the supply chain side, with the food retailers looking at how they manage water in their smaller geography to demonstrate compliance with whatever policy is coming in.

So the beachhead market is government, but then there’s the follow-on going with the big supply-chain companies and eventually the farm-by-farm level.

That’s a big topic. Are there multiple Series A/B companies diving into it?

Martin: You’d be surprised. There are companies with multiple millions in turnover in this area now. They have demonstrated market traction, are scaling quickly and need investment to scale up their infrastructure and tackle the opportunity that’s out there.

What is their infrastructure?

Martin: Some are using public infrastructure to demonstrate the market and to show the potential of the technology. Then they are going to add some of their own infrastructure to it to improve repeat cycles and improve the volume of data they can produce and the acreage they can produce simultaneously.

Some will continue to use public data or will use commercial data from other suppliers. There is a range of business models. But that market is now starting to open up.

Could a candidate company for your fund be planning its own satellite constellation?

Martin: It might be. We are looking at the end-user applications and the impacts, but we’re looking up and down the supply chain to see who are the people who are going to unlock impact value at the far end. Some will have their own constellations, some will be managing constellations and then feeding through to the end suppliers.

Bartin: We have been in the Agritech sector for a long time. So we understand that space really well and we are just combining the two. I spoke to a conference last year of about 60 farmers. I asked them to raise their hands if they used space technology. About 10 of them did. I thought: That’s good. Then I asked, how many of you use only drone technology, and nine of them raised their hands.

Farmers and the big aggregators that sell to farmers don’t want any apps that say “space” on it. If they have to have a space app to make their farm more sustainable, they only want one app.

Credit: Citicourt

At Citicourt we are rolling companies up, and we’ll do that with our fund as well. The way to grow your business isn’t always through raising and deploying capital and spending over a long period of time. A good option is to buy a business that will bring you into a new geography, or bring you a product that allows you to build your business base overnight with the same customers.

We are going to utilize use opportunities including M&A in addition to the companies that we invest in to deploy capital to grow. There is a huge number of space companies that probably need to be rolled up. We will continue to find companies that are reasonable and realize that a smaller piece in a bigger pie is an alternative way forward.

A fund of 30 to 100 million pounds, that upper figure would include other investors coming in after you?

Martin: If we are the lead investor in a round, then there might be two or three times whatever we invest coming from others. We expect that with a fund at 100 million pounds we would leverage two or three or even more form other investors alongside our investment.

How many Seed A and B companies would be in the fund?

Bartin: Around fifteen. Generally you would put in a third of your funding and then hold back about 66% for subsequent rounds.

What is the expected geographic distribution?

Bartin: The majority are probably going to be UK and European companies. But it’s a global fund, and we are looking at companies in Asia as well. There are companies in America that, believe if or not, we’re finding are quite reasonable in their valuation expectations. They’re rare but there are some.

Martin: We have no geographic restrictions but because we are based in Europe and know the ecosystem and the market here better, that’s likely to be where the critical mass is. But when we do later funds we’ll be looking at locations and set up a presence in other places around the world. That’s the longer-term plan.

Lots of things can happen and the space industry can be a wild ride. But you are confident in your thesis and in your ability to stand the fund up this year?

Bartin: We wouldn’t do this if we didn’t have the confidence that there was huge demand for generalist investors to come into the space industry. They are telling us that every day. That’s what is feeding this fund. The government and institutional support that we’re getting — we get as many No’s as we get Yes’s, but we are still getting positive response in building the book. So there will be an amount and we’re fairly comfortable that it’s going to be at least 30 million.

Share this article

Explore our site

Our CEO had the honour of being invited to 11 Downing Street and representing Citicourt & Co, as part of our continued support for the Royal Museums Greenwich, a nearly 350 year old organisation. Thank you for a wonderful evening and discussions all about fascinating 17th century Britain and Newton!

In June, the yen hit JPY160.7 against the US dollar, its weakest level since 1986. For foreign tourists, this is a great opportunity to visit the Land of the Rising Sun for magnificent cuisine, culture and landscapes.